The score lenders use

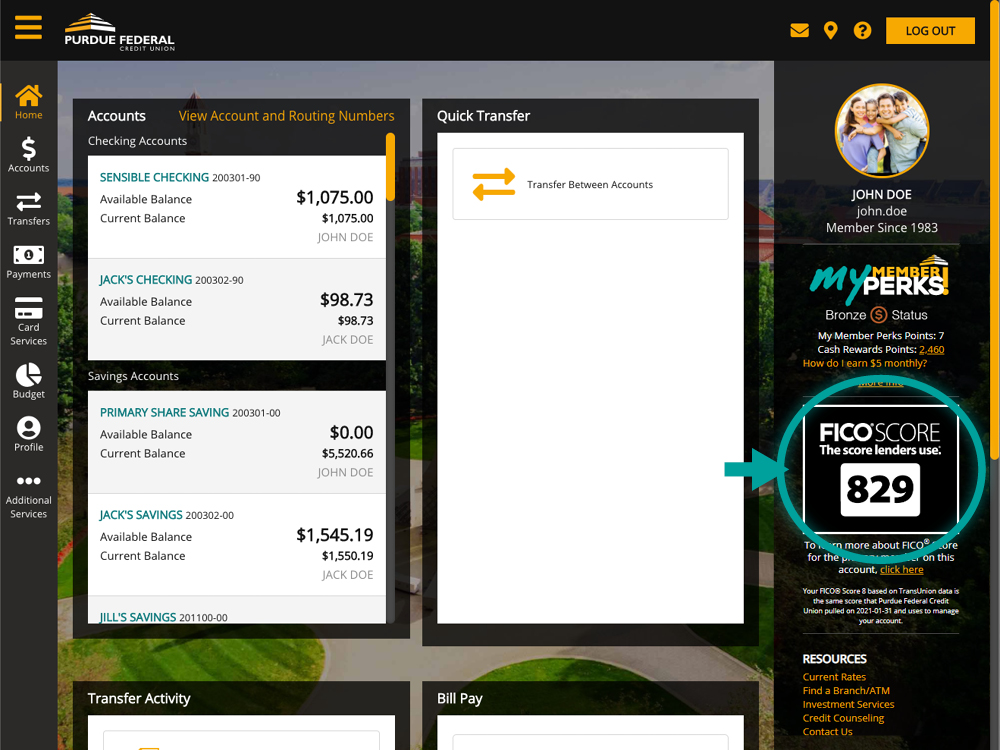

Primary members on Purdue Federal accounts who are eligible for a credit score can now view their FICO® Score for free.

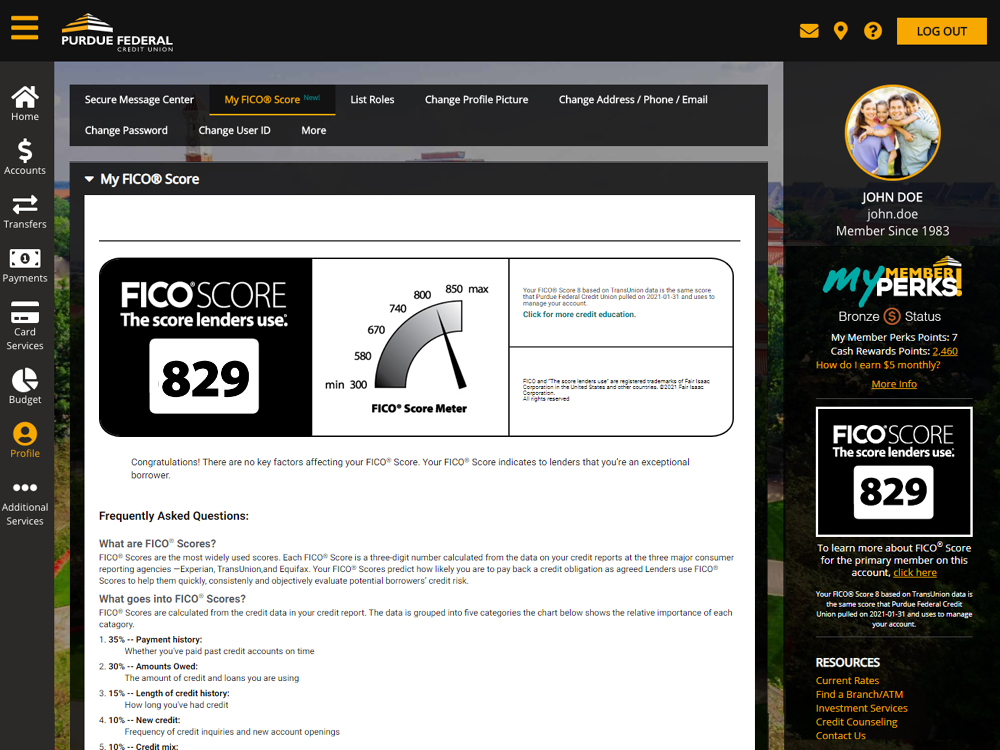

This feature enables you to:

- Have free online access to your FICO® Score

- See the key factors that affected your FICO® Score

- Read educational content on FICO® Scores and financial health and more

We’ll update your FICO® Score quarterly, but remember that viewing your FICO® Score will not affect your score – so visit it as often as you want.

How to See Your Score

- Log in to digital banking.

- In the menu, go to Profile > My FICO® Score.

- If it’s your first visit to this page, enroll your account. (You can unenroll any time.)

- View your FICO® Score.

View our full Digital Banking Guide

Learn what is a FICO® Score here.

FAQs

- Payment History - Approximately 35%

- Amounts You Owe - Approximately 30%

- Length of Credit History - Approximately 15%

- New Credit - Approximately 10%

- Types of Credit in Use - Approximately 10%

*FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Purdue Federal Credit Union and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Purdue Federal Credit Union and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.