Most Popular Questions

Yes, please call us at 800.627.3328 or stop by a branch and we’ll be able to assist you with this.

Please call us at 800.627.3328 or stop by a branch and we’d be happy to assist you.

Please clear your internet browser's cache by pressing “CTRL then F5”. This should resolve the glitch.

We’re currently working to get this resolved. We apologize for any inconvenience!

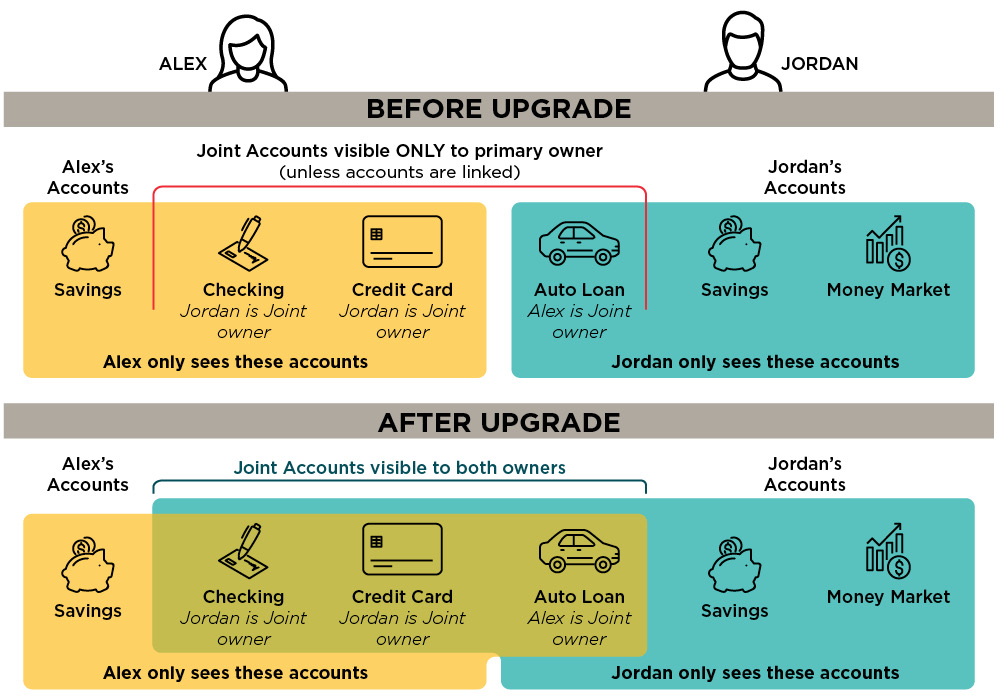

Most likely you had view-only access via linked accounts. To better protect our members and their accounts, after the system upgrade you will only see accounts for which you are the primary accountholder, joint accountholder, Power of Attorney or Trustee.

If you would like to be made a joint accountholder, Power of Attorney or Trustee on an account you saw before the upgrade, please call us at 800.627.3328 or stop by a branch and we’d be happy to assist you. Note: Purdue Federal will have to contact the primary accountholder of the account to authorize this request.

You will see a $5 Member Ownership in digital banking and on your account statements. This shows you are a member-owner of our nonprofit cooperative. Previously, your $5 was held in your Primary Share Savings Account as a balance unavailable for withdrawal. In our upgraded system, you will see your Member Ownership listed and held in a separate account. We made this change to allow members who do not want a savings account to have that option. You will not be able to transact on this new account; it simply holds your $5 ownership in the credit union.

When someone new joins the credit union, they are required to deposit $5 into their Member Ownership to open their membership. Every Primary Member has an Member Ownership Share account based on their unique Tax ID. For example, if you’re joint on your child’s account and saw the $5 taken out, but don't see their own Member Ownership Share account, you will see that new account where their $5 is being held on their monthly statement or you can register them for digital banking. Please note: you’ll need a Digital Banking Access Code to register; you’ll receive this code soon in the mail or you may contact us and we’d be happy to assist.

What's Changed and What's Stayed the Same

What has stayed the same

Many things you use on a daily basis are unchanged following the upgrade period. You’ll be happy to know the below items have remained the same:

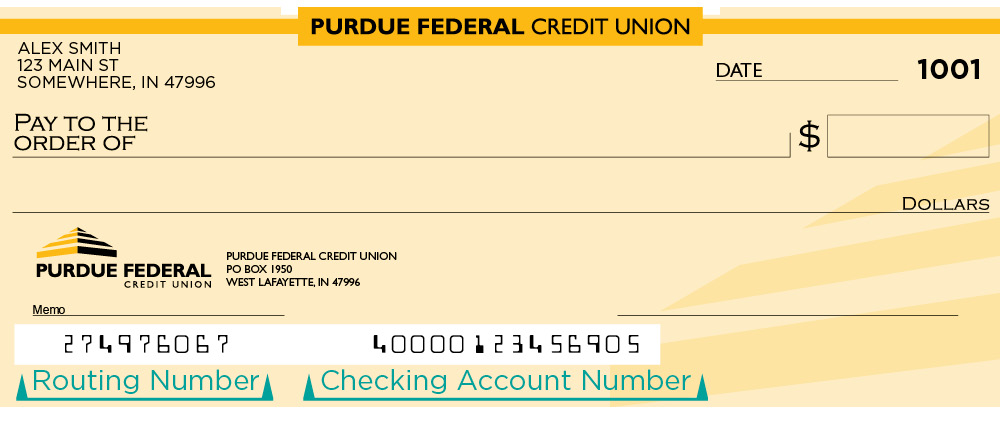

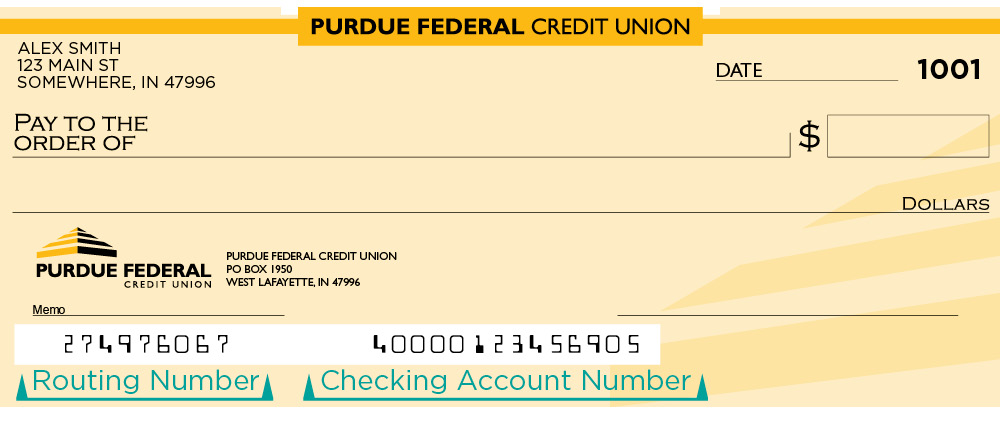

- Purdue Federal’s routing number—274976067

- PINs for debit cards, credit cards and Bank-by-Phone

- Debit and credit cards will not be reissued; card numbers remain the same

- Digital banking usernames and passwords

- Account nicknames in digital banking

- Direct deposits, government-issued benefits, automatic payments (ACH) and scheduled transfers

- Scheduled payments, external transfers or payments from other financial institutions to Purdue Federal loans or credit cards

- Checks—you do not need to order new checks because the 14-digit Magnetic Ink Character Recognition (MICR) number on your current Purdue Federal-issued checks, which allows your checks to be read by computers, will be your new checking account number; you can check your 14-digit number in digital banking under Accounts – Account and Routing Numbers. Note: if you order checks through a 3rd party, please ensure you’re using the correct checking account number at the bottom of your checks.

What has changed

You will see some changes including your member ownership, account numbers and viewing joint accounts.

You will see a $5 Member Ownership in digital banking. This shows you are a member-owner of our nonprofit cooperative. Previously, your $5 was held in your Primary Share Savings Account as a balance unavailable for withdrawal. In our upgraded system, you will see your Member Ownership listed and held in a separate account. Please note: You will not be able to transact on this new account; it simply holds your $5 ownership in the credit union.

Any authorized signer on your Health Savings Account (HSA) will now be able to see and transfer funds out of your HSA in digital banking.

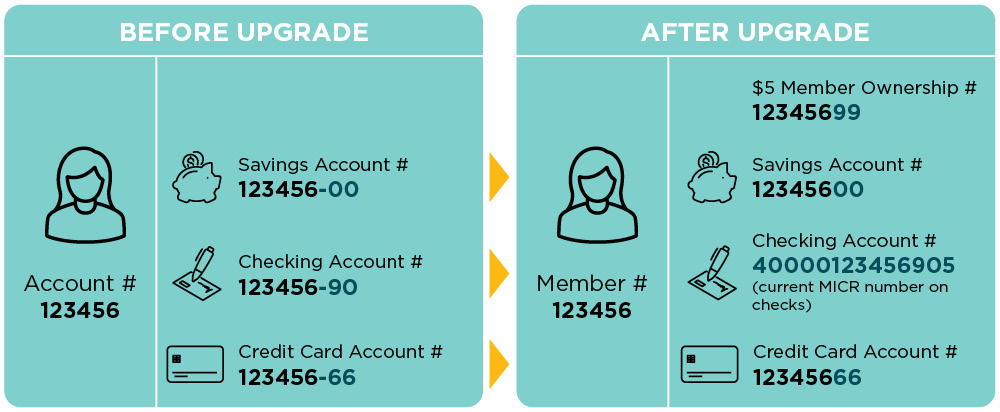

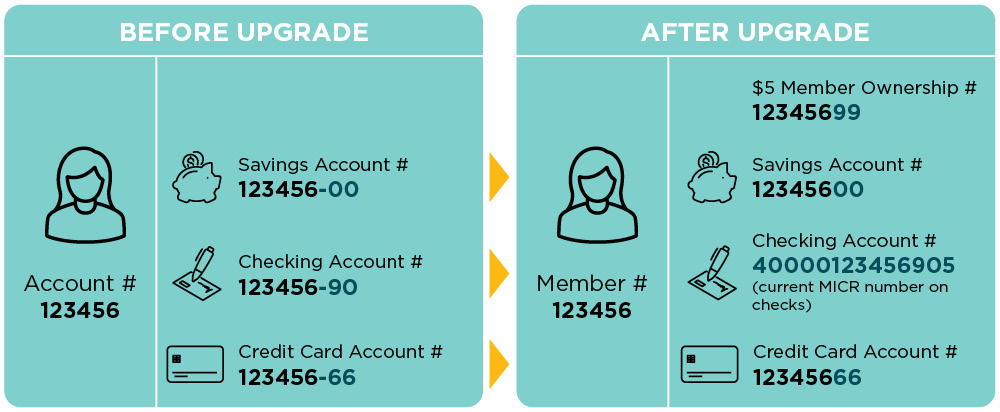

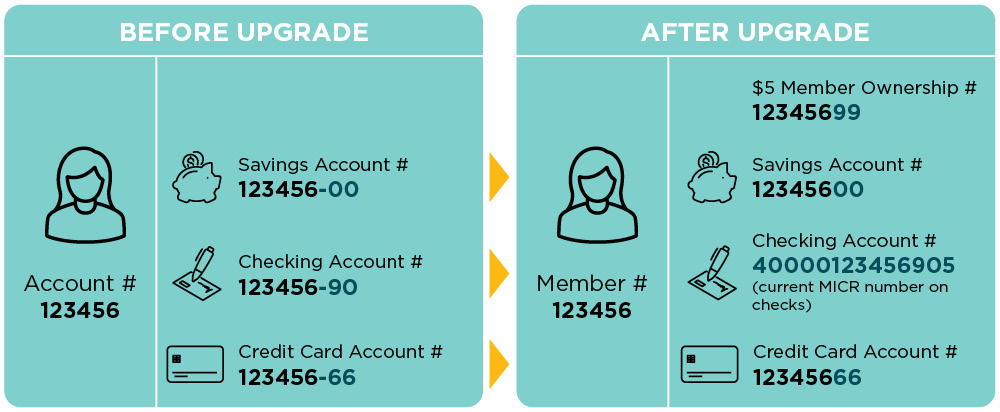

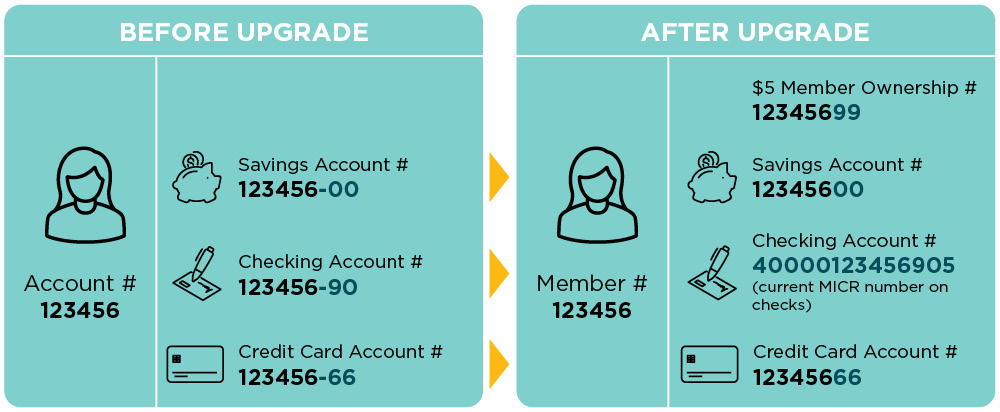

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

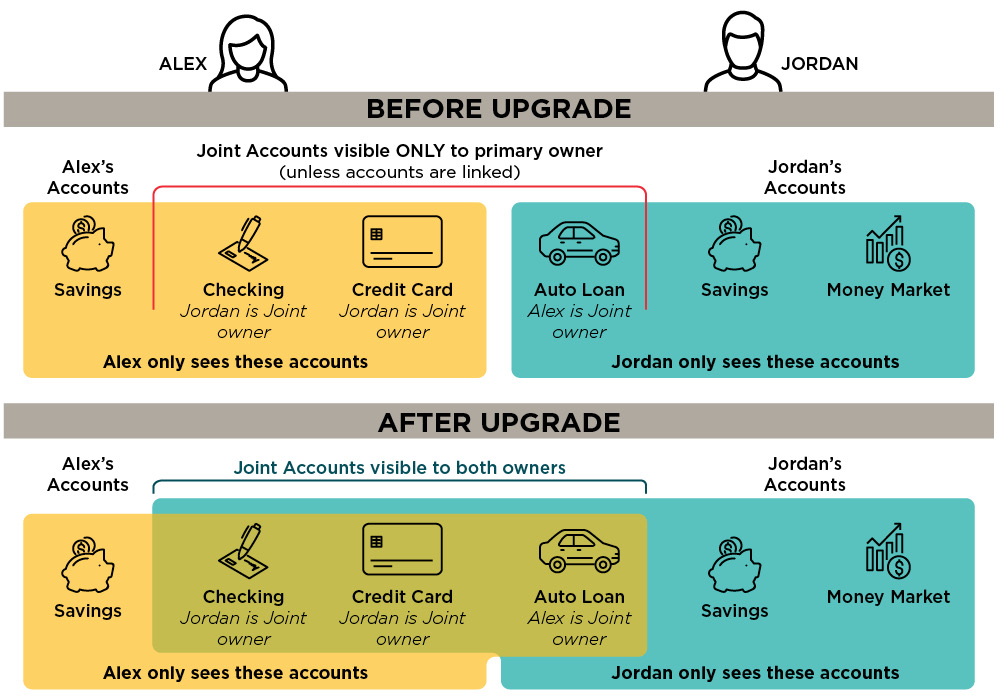

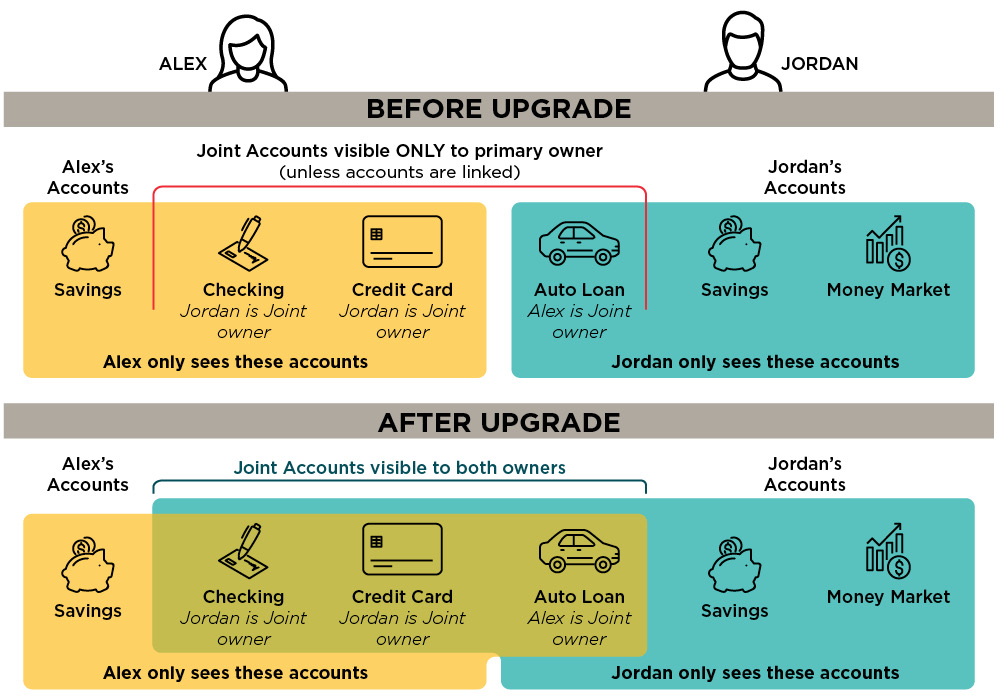

Accounts are now structured differently in digital banking to give you a more complete view of your financial picture. You will see all accounts associated with your Social Security/Tax ID Number. This means you’ll see all accounts for which you are primary accountholder, joint accountholder, trustee, Power of Attorney and more. Our upgraded system will generate account statements according to the primary accountholder’s Tax ID number. In order for a joint accountholder to see a statement for which they have a role, they will need to request a copy from us.

Joint accountholders will now be able to set up their own digital banking username and password to view their accounts, transfer funds, pay bills and more. In order to set up digital banking, joint accountholders will need a Digital Banking Access Code, which they will receive after the system upgrade is complete.

Please note: If you were not a joint accountholder on an account that you saw before the upgrade, you will not be able to view or access the account now.

General Questions

We have upgraded our core system in order to meet our members’ needs quickly and proactively with new products and services.

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

Beginning with April statements that mail in May, our system will generate monthly statements according to the primary accountholder’s Tax ID number. In order for a joint accountholder to see a statement, they will need to request a statement copy from us or the primary accountholder. Our system will also create a separate statement showing credit card transactions.

Purdue Federal’s routing number has remained the same—274976067.

Digital Banking Questions

Yes, please call us at 800.627.3328 or stop by a branch and we’ll be able to assist you with this.

Please call us at 800.627.3328 or stop by a branch and we’d be happy to assist you.

Please clear your internet browser's cache by pressing “CTRL then F5”. This should resolve the glitch.

We’re currently working to get this resolved. We apologize for any inconvenience!

Most likely you had view-only access via linked accounts. To better protect our members and their accounts, after the system upgrade you will only see accounts for which you are the primary accountholder, joint accountholder, Power of Attorney or Trustee.

If you would like to be made a joint accountholder, Power of Attorney or Trustee on an account you saw before the upgrade, please call us at 800.627.3328 or stop by a branch and we’d be happy to assist you. Note: Purdue Federal will have to contact the primary accountholder of the account to authorize this request.

Member Ownership

You will see a $5 Member Ownership in digital banking. This shows you are a member-owner of our nonprofit cooperative. Previously, your $5 was held in your Primary Share Savings Account as a balance unavailable for withdrawal. In our upgraded system, you will see your Member Ownership listed and held in a separate account. Please note: You will not be able to transact on this new account; it simply holds your $5 ownership in the credit union.

Health Savings Accounts

Any authorized signer on your Health Savings Account (HSA) will now be able to see and transfer funds out of your HSA in digital banking.

Account Numbers

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

Viewing Joint Accounts

Accounts are now structured differently in digital banking to give you a more complete view of your financial picture. You will see all accounts associated with your Social Security/Tax ID Number. This means you’ll see all accounts for which you are primary accountholder, joint accountholder, trustee, Power of Attorney and more. Our upgraded system will generate account statements according to the primary accountholder’s Tax ID number. In order for a joint accountholder to see a statement for which they have a role, they will need to request a copy from us.

Joint accountholders will now be able to set up their own digital banking username and password to view their accounts, transfer funds, pay bills and more. In order to set up digital banking, joint accountholders will need a Digital Banking Access Code, which they will receive after the system upgrade is complete.

Please note: If you were not a joint accountholder on an account that you saw before the upgrade, you will not be able to view or access the account now.

Your digital banking username and password has not changed.

No, your account nicknames have not changed.

We recommend that you review payees to ensure the information is correct now that the upgrade is complete.

No, you will not need to set up your credit card and loan payments again in digital banking; however, we recommend that you review them now that the upgrade is complete.

Your account history is still be available by clicking Accounts – Account History.

A person who is a joint owner/secondary user on an account can now have their own digital banking username and password to access the account. This also allows the joint owner to sign up to see their FICO® Score within digital banking. Joint accountholders will receive a mailed letter that provides their Digital Banking Access Code. This code is required to enroll in digital banking and to unlock their digital banking account if it is ever locked.

Credit and Debit Card Questions

Please clear your internet browser's cache by pressing “CTRL then F5”. This should resolve the glitch.

Your 16-digit credit card number that appears on your card is unchanged so you will not receive a new physical card. However, your credit card account number has become your old account number merged with your credit card suffix.

You do not need to set up any reoccurring debits or credits; they will continue as normal.

Your debit or credit card PIN has not changed.

Deposit Account Questions

We’re currently working to get this resolved. We apologize for any inconvenience!

Most likely you had view-only access via linked accounts. To better protect our members and their accounts, after the system upgrade you will only see accounts for which you are the primary accountholder, joint accountholder, Power of Attorney or Trustee.

If you would like to be made a joint accountholder, Power of Attorney or Trustee on an account you saw before the upgrade, please call us at 800.627.3328 or stop by a branch and we’d be happy to assist you. Note: Purdue Federal will have to contact the primary accountholder of the account to authorize this request.

Health Savings Accounts

Any authorized signer on your Health Savings Account (HSA) will now be able to see and transfer funds out of your HSA in digital banking.

Account Numbers

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

You will see a $5 Member Ownership in digital banking and on your account statements. This shows you are a member-owner of our nonprofit cooperative. Previously, your $5 was held in your Primary Share Savings Account as a balance unavailable for withdrawal. In our upgraded system, you will see your Member Ownership listed and held in a separate account. We made this change to allow members who do not want a savings account to have that option. You will not be able to transact on this new account; it simply holds your $5 ownership in the credit union.

When someone new joins the credit union, they are required to deposit $5 into their Member Ownership to open their membership. Every Primary Member has an Member Ownership Share account based on their unique Tax ID. For example, if you’re joint on your child’s account and saw the $5 taken out, but don't see their own Member Ownership Share account, you will see that new account where their $5 is being held on their monthly statement or you can register them for digital banking. Please note: you’ll need a Digital Banking Access Code to register; you’ll receive this code soon in the mail or you may contact us and we’d be happy to assist.

No, you do not need to order new checks. The 14-digit Magnetic Ink Character Recognition (MICR) number on your Purdue Federal-issued checks are your new checking account number.

We recommend that you review your checks to ensure your entire 14-digit MICR number is there. You can find your 14-digit number in digital banking under Accounts – Account and Routing Numbers.

If you order checks through a third-party, please ensure you’re using the correct checking account number at the bottom of your checks.

If you have direct deposit set up for your payroll or government-issued benefits, your direct deposit will continue normally. You do not need to take any action.

Loan Questions

Loan account numbers have changed. You’ll be able to find your new loan account numbers in digital banking under Accounts – Account and Routing Numbers.

We appreciate your patience and understanding as we have upgraded our system! Thank you for your membership.

If you have questions, please stop by your favorite branch, or call us at 800.627.3328 or 765.497.3328.