Most Popular Questions

We are aware of the outage and are working with our vendor to fix the problem.

Due to system limitations, we can only give you access to your business and personal accounts via your business username. If you contact us, we would be happy to perform maintenance on your accounts to get your accounts linked through your business username.

This is an issue we are aware of. Please e-mail [email protected] or you can call them directly at 765.269.4570 for assistance.

What's Changed and What's Stayed the Same

What has stayed the same

Many things you use on a daily basis are unchanged following the upgrade period. You’ll be happy to know the below items have remained the same:

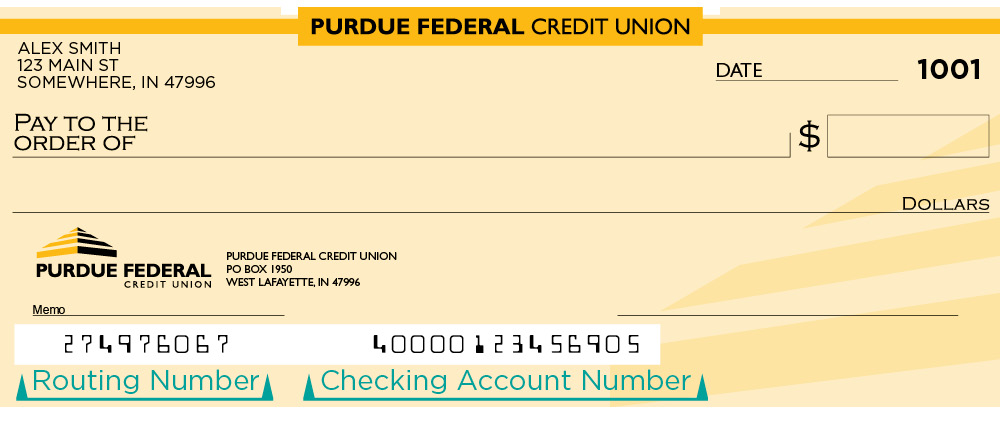

- Purdue Federal’s routing number—274976067

- PINs for debit cards, credit cards and Bank-by-Phone

- Debit and credit cards will not be reissued; card numbers remain the same

- Digital banking usernames and passwords

- Account nicknames in digital banking

- Direct deposits, government-issued benefits, automatic payments (ACH) and scheduled transfers

- Scheduled payments, external transfers or payments from other financial institutions to Purdue Federal loans or credit cards

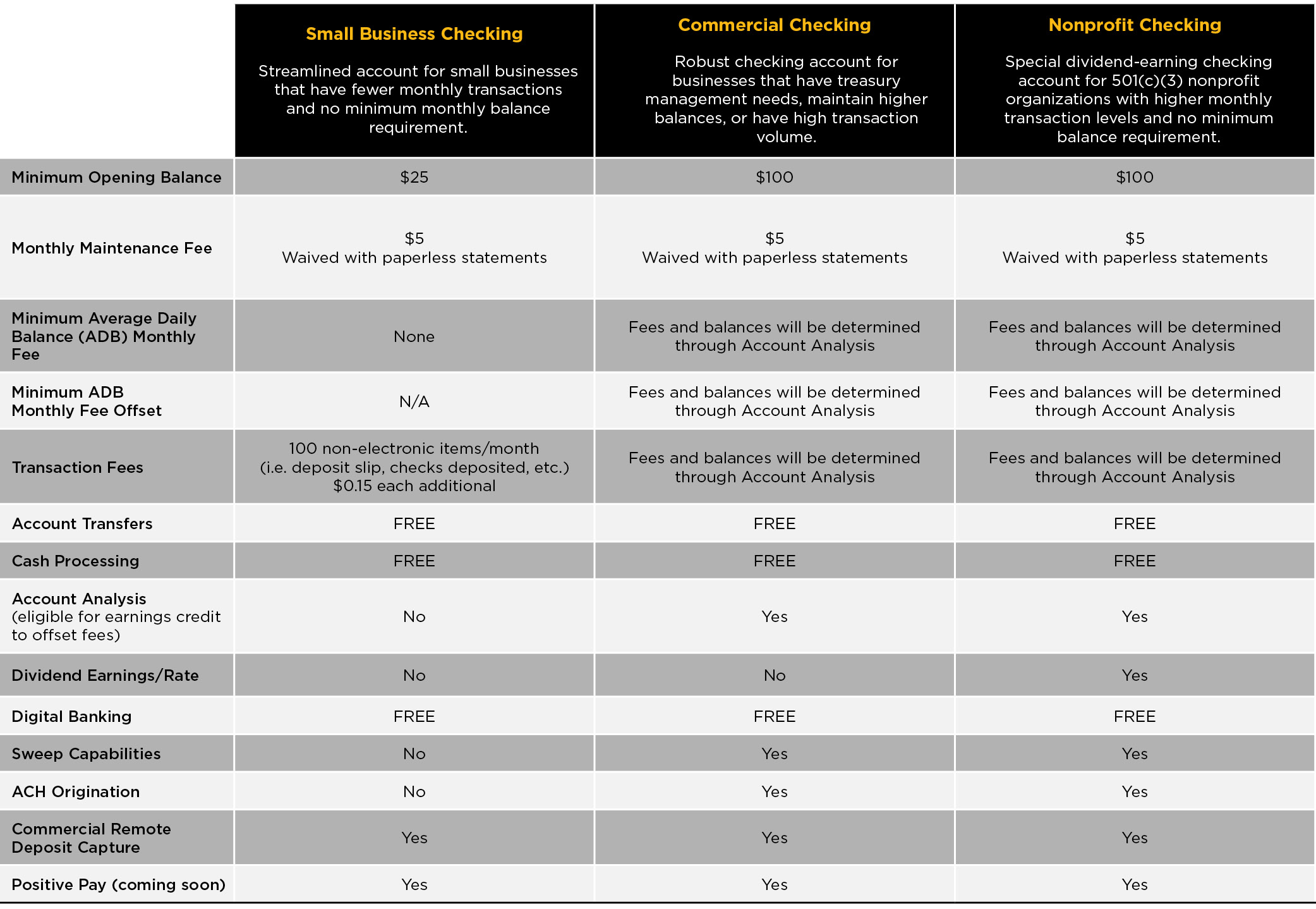

- Checks—you do not need to order new checks because the 14-digit Magnetic Ink Character Recognition (MICR) number on your current Purdue Federal-issued checks, which allows your checks to be read by computers, will be your new checking account number; you can check your 14-digit number in digital banking under Accounts – Account and Routing Numbers. Note: if you order checks through a 3rd party, please ensure you’re using the correct checking account number at the bottom of your checks.

What has changed

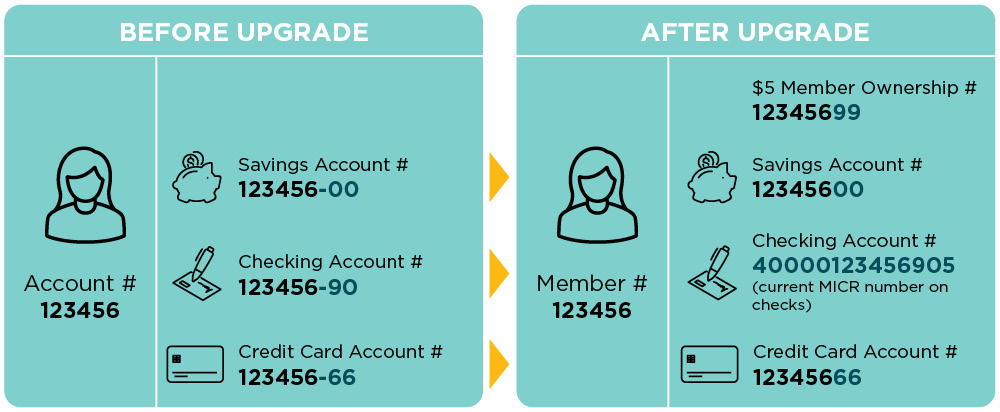

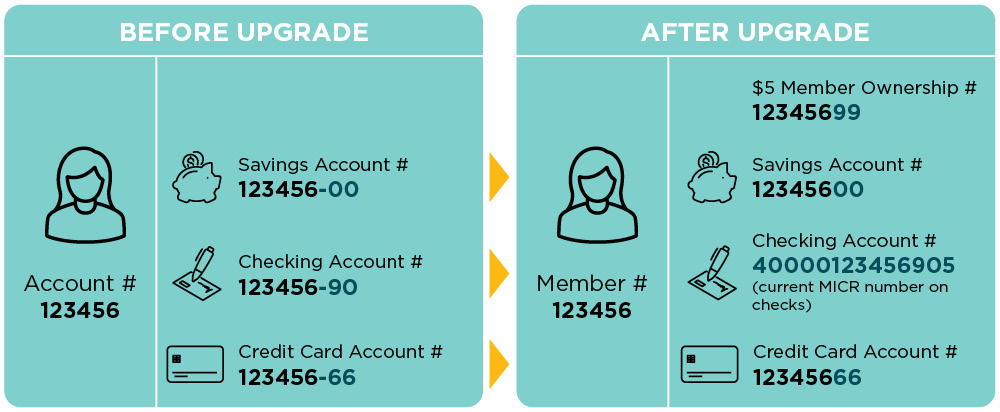

You will see some changes which include your member ownership and account numbers.

Going forward, you must use a deposit slip when you make a deposit at a branch. Deposit slips help ensure your deposit is credited to the correct account. You can request deposit slips at any branch.

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

You will see a $5 Member Ownership in digital banking. This shows you and/or your business is a memberowner of our nonprofit cooperative. Previously, your $5 was held in your Primary Share Savings Account as a balance unavailable for withdrawal. In our upgraded system, you will see your Member Ownership listed and held in a separate account. Please note: You will not be able to transact on this new account; it simply holds your $5 ownership in the credit union.

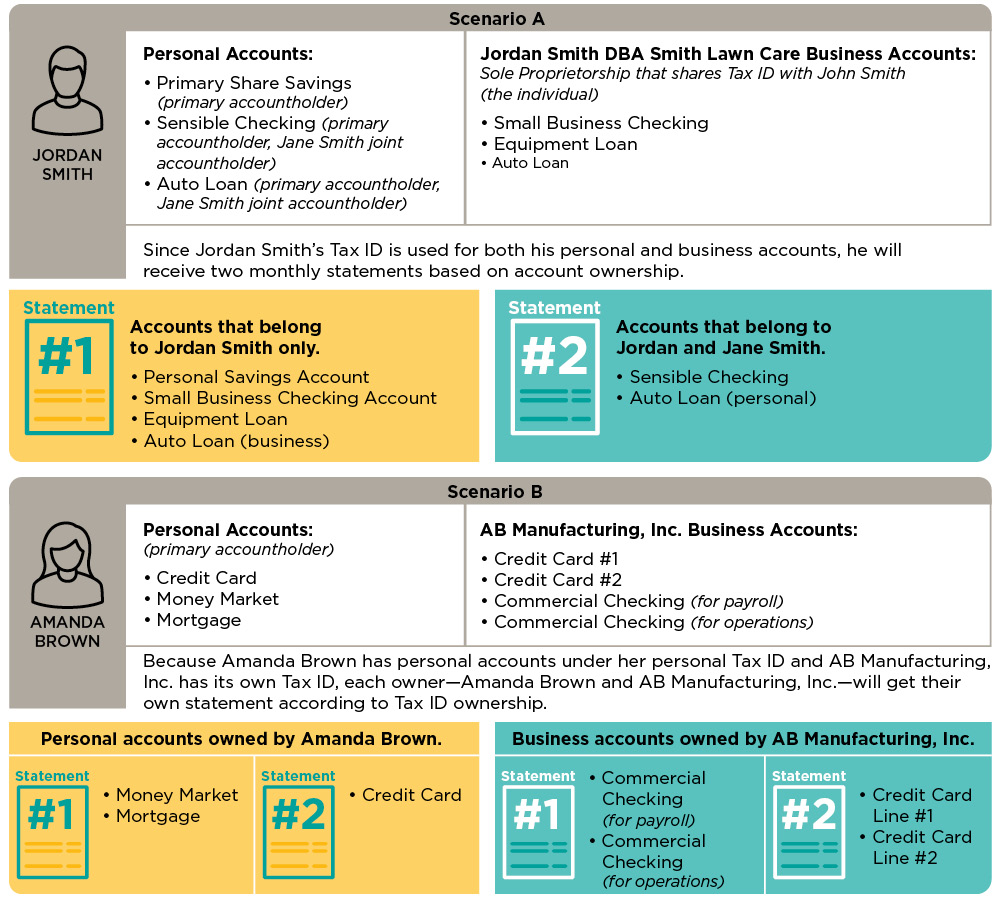

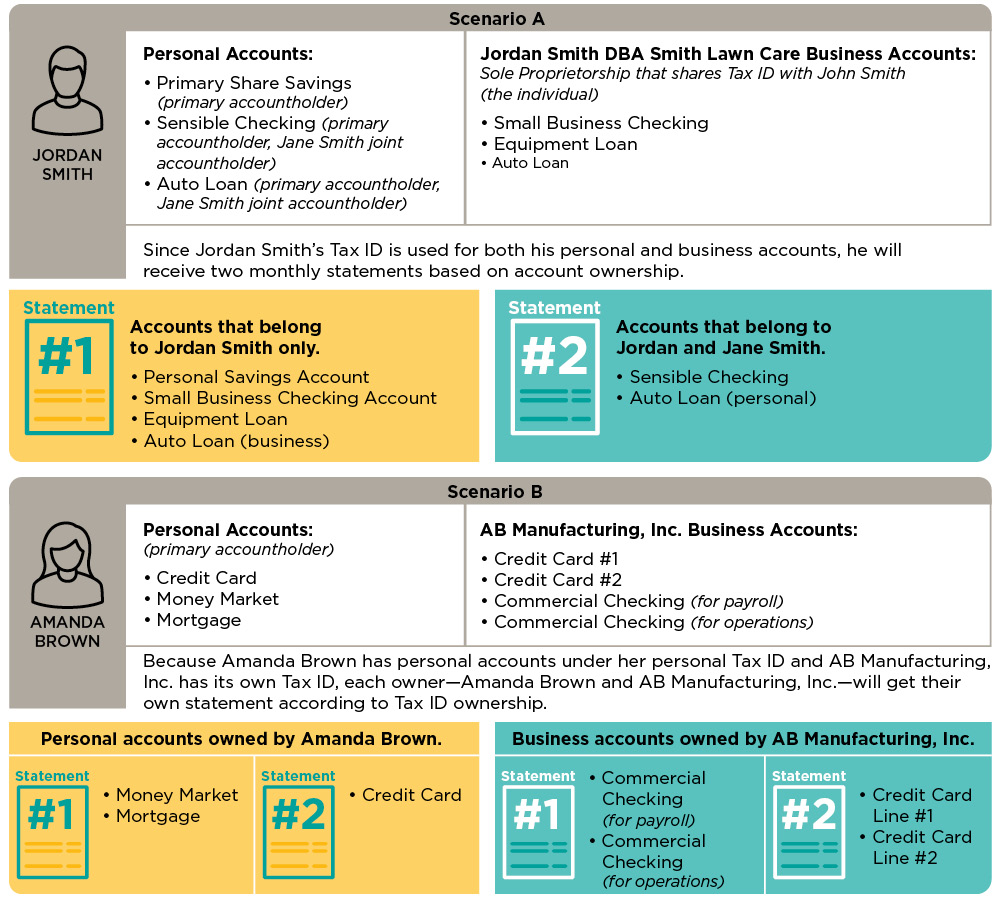

Your monthly account statements are now organized differently than they were before the upgrade. Starting with your April account statement (to be received in May), your account statements will be grouped by ownership type and Tax Identification Number.

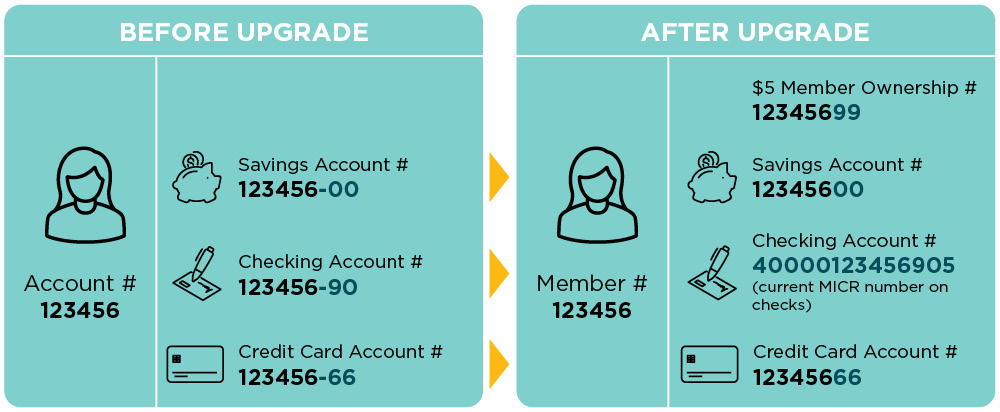

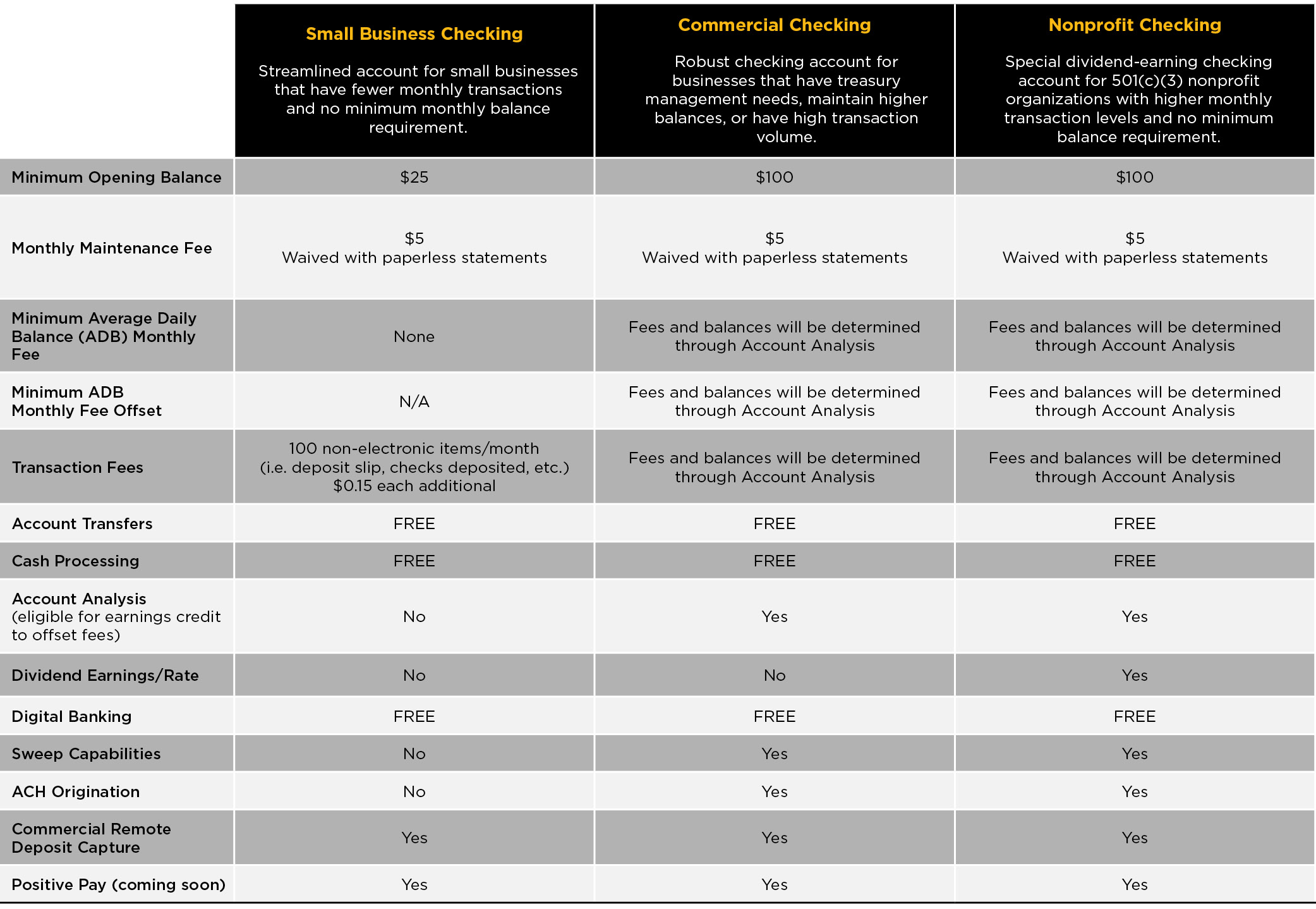

With our system upgrade, we are excited to offer new checking accounts for our business members.

*ACH origination services are for ACH payroll payments to employees.

General Questions

We have upgraded our core system in order to meet our members’ needs quickly and proactively with new products and services.

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

Beginning with April statements that mail in May, our system will generate monthly statements according to the primary accountholder’s Tax ID number. In order for a joint accountholder to see a statement, they will need to request a statement copy from us or the primary accountholder. Our system will also create a separate statement showing credit card transactions.

Purdue Federal’s routing number has remained the same—274976067.

Business Banking Questions

Your monthly account statements are now organized differently than they were before the upgrade. Starting with your April account statement (to be received in May), your account statements will be grouped by ownership type and Tax Identification Number.

Going forward, you must use a deposit slip when you make a deposit at a branch. Deposit

slips help ensure your deposit is credited to the correct account. You can also request blank deposit

slips at any branch.

While your account numbers will look a little different, you won’t have to do anything to your accounts and everything will function as it did before. After the upgrade:

- Savings account numbers are your old account number merged with your savings suffix.

- Checking account numbers have converted to be the 14-digit MICR account numbers shown at the bottom of your Purdue Federal-issued checks.

- Credit card account numbers are now your old account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

We encourage you to log in to digital banking to view all your account numbers; go to Accounts – Account and Routing Numbers.

Please see below for a common scenario for account number changes:

Your business credit card has two numbers—an account number and a card number. Credit card account numbers are now your current account number merged with your credit card suffix. Your 16-digit credit card number that appears on your card remains unchanged so you will not receive a new physical card.

With our system upgrade, we are excited to offer new checking accounts for our business members.

*ACH origination services are for ACH payroll payments to employees.

The system upgrade provides some digital banking enhancements for you and your secondary users including showing all accounts under one membership and no limit on the number of credit cards under one membership.

If you have multiple users logging in to digital banking to view, transact, etc., on your accounts, we recommend that you log in to ensure you and your secondary users (also known as entitled users) have the appropriate account access and permissions for their roles.

Your business digital banking username and password has not changed.

Our business services department has reviewed your account history for the past 18 months and has determined which account product is most advantageous to your business.

We are happy to answer questions in more depth. If you would like for a relationship manager to reach out, please just let us know:

- Member Account

- Contact

- Best method for contact

- Best time to contact

Certain types of Business Checking accounts, including Commercial Checking and Non-Profit Checking, will be equipped with Account Analysis. Such accounts are eligible for an earnings credit to offset eligible fees charged by the Credit Union (“Earnings Credits”). Unlike dividends, Earnings Credits are not paid to you directly.

Using Account Analysis, we perform a detailed accounting of your Earnings Credits and eligible fees. If your Earnings Credits are greater than the total eligible fees and expenses for a given statement period, the eligible fees are offset by the Earnings Credits for that period.The remaining Earnings Credits are forfeit and are not carried forward to the following statement period.

If your fees and expenses exceed the amount of Earnings Credits for a given statement period, we will debit your account for the difference. The Earnings Credits do not constitute cash and may only offset accrued fees. Account fees that can be offset by the Earnings Credits are generally direct fees charged by Purdue Federal related to account activity or transactional items, account maintenance fees, and treasury management products, including but not limited to wires, ACH, remote deposit capture, and sweep/zero balance accounts.

Please contact Member Business Services for more information about eligible fees. Any account fees charged will be automatically debited on the fifteenth (15th) of each month. The Account Analysis will be provided upon request. Please contact Member Business Services for current Earnings Credit rate information.

It is because you are currently not in a non-profit checking account. If you are a non-profit and want to move to a Non-Profit Checking, we can review the corporate documentation on file and let you know what if any additional information we might need to change over your account.

Option 1

Purdue Federal evaluates your account activity and lets you know what your situation would look like.

Option 2

Purdue Federal moves you over to the Small Business Checking if it is a better fit for your quest to not pay any fees.

After the System Upgrade, only one username will survive per Tax ID. The last active or locked username to login when digital banking is disabled on 3/31 will be the surviving username. If you worked with our Member Business Services team before the upgrade to choose the surviving username, please use that username to login now.

It is possible your primary user account did not convert properly. Please contact us at 800.627.3328 to speak to our team to resolve this issue.

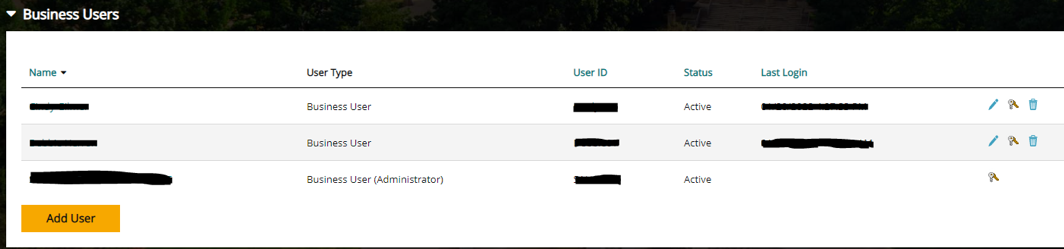

Administrators need to use the desktop version of digital banking to manage secondary users.

If you had a username that did not survive, all external accounts, scheduled transfers, alerts, and secondary users it had will need to be re-established under the surviving username.

You first need to be enrolled in Business Banking. Then follow the instructions below to set up secondary users. You will need your Business Banking Access Code for new enrollments.

Secondary Users

Once you have you have registered your business account for digital banking, you can add secondary users to your account and assign them permissions.

Select Manage Users under Profile from the main menu.

Manage Users

There are many options to manage users connected to your business account:

- To add a secondary user, click the gold Add User button.

- Pencil Icon: Edit general user information. (Password Reset, Update Contact info, etc.)

- Key Icon: Edit entitlements. (Customize entitlements for business needs based on user's role)

- Trash Can Icon: Delete user.

Reset Existing User's Password

- Click the Pencil Icon next to the user requiring the reset.

- With their profile open, click Reset Password.

- Issue another temporary password and share it with your employee.

Add Users

- Click the gold Add User button, then fill out the required fields (*). The password issued will be temporary and the employee will be prompted to update it once they log in.

- Click Submit.

- Choose the user's role. These roles are 100% customizable.

- Full Access Employee: All access excluding managing Secondary Users.

- Limited Access: View account, Deposit and Stop Checks, Card Services (i.e. place travel notification, report fraud, etc.).

- Read-only: View account and deposit checks

- Full Access Owner: All access (similar to Admin User), including Secondary Users.

- Choose the user's entitlement package. Check the boxes the employee is entitled to do.

- Click Save and then Confirm to finalize your changes.

We are aware of the outage and are working with our vendor to fix the problem.

Due to system limitations, we can only give you access to your business and personal accounts via your business username. If you contact us, we would be happy to perform maintenance on your accounts to get your accounts linked through your business username.

If they are seeing accounts tied to another membership, it is most likely that Multi-profile has been set up on the account or the secondary user has been given this access through Entitlements of Business Digital Banking. If you have Business Digital Banking, check Entitlements to see if you can uncheck the accounts you want hidden from your Secondary Users. If that does not fix your issue, please call us and we can break the Multi-profile link.

This is an issue we are aware of. Please e-mail [email protected] or you can call them directly at 765.269.4570 for assistance.

We appreciate your patience and understanding as we have upgraded our system! Thank you for your membership.

Please visit this page again for the most up-to-date information. If you have questions, please stop by your favorite branch, or call us at 800.627.3328 or 765.497.3328.