Keep a close eye on your transactions.

You love the convenience of contactless payment and the perks of earning cash rewards, so you probably use your credit card all the time. But credit card fraud can happen, so it’s a good idea to take steps to prevent it or report it quickly.

How to Report Card Fraud

Call us at 765.497.3328 or 800.627.3328.

Or

Login to Purdue Federal Digital Banking.

Select Lost and Stolen Cards from the main menu under Card Services.

Once you’ve reported a fraud dispute, your card will be blocked so that no further transactions can be approved on the card by the fraudster.

Visa® requires specific paperwork for disputing unauthorized charges whether it is suspected fraud or simply an error by the retailer. We can help you with the necessary paperwork and in some cases provide provisional credit until your dispute is handled. Within 90 days we will either correct the error or explain why we believe the transaction was correct.*

Need to dispute a non-fraud transaction? Learn about the difference between fraud and non-fraud disputes and what materials are required.

Card Fraud Alerts

Purdue Federal has partnered with CO-OP to provide automated fraud detection and alerts for debit and credit cards. All Purdue Federal Visa debit and credit cardholders are automatically enrolled in fraud alerts.

How do fraud alerts work?

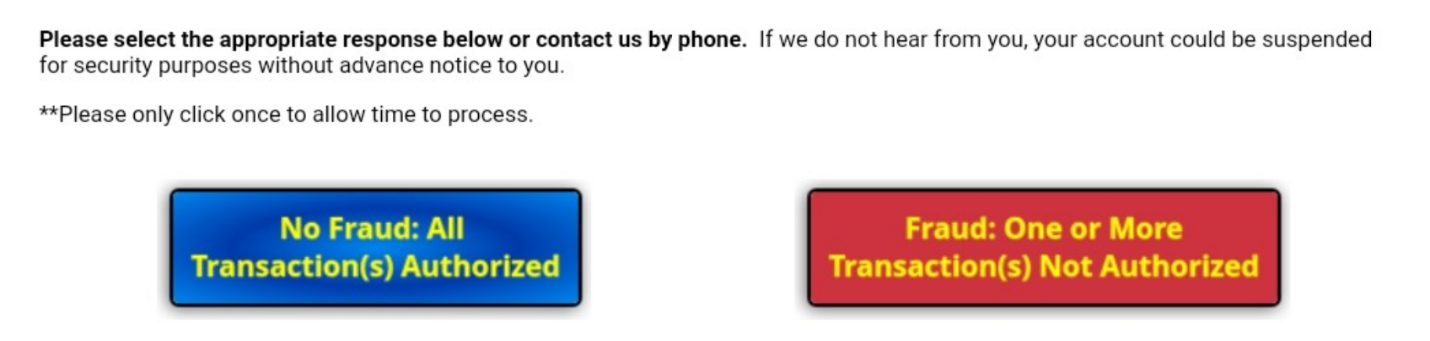

When a suspicious transaction occurs, you’ll receive an alert. You can follow the message instructions to respond and confirm if you recognize the transaction or not, as seen below.

If you don’t recognize the transaction, your card will automatically be blocked until you can reach the provided contact number about a solution. If you do recognize the transaction, you will be able to continue using your card uninterrupted.

How will you receive alerts?

You’ll receive alerts via text message and email, as well as by phone call if the alert is sent between 8 a.m. and 9 p.m. in your time zone.

Phone calls will come from 866.518.0213. Our fraud alerts come from [email protected] via email.

FYI: You can opt out of these alerts at any time by selecting the opt-out option on an alert message or by contacting us. You can opt in again whenever you choose by visiting Alerts under Additional Services in digital banking.

How to Protect Yourself from Card Fraud

- Validate your card. Sign new credit cards with permanent ink as soon as you get them.

- Know your PIN. If your card has a PIN, memorize it. Skip easily recognizable PINs such as the last four digits of your Social Security Number or phone number.

- Know whom you're dealing with. Providing your personal and financial information to anyone can lead to ID theft and phishing attacks.

- Beware of phone scams. Never give your PIN or any other personal financial information to an unknown caller.

- Track financial statements. Find out when financial statements and plastic cards are due to arrive. If they're late, contact your credit union or appropriate issuer.

- Protect yourself online. New technology allows online vendors to assure customers reasonable security from online theft. If you’re in doubt, order over the phone.

Purdue Federal Credit Union serves members worldwide and operates branches throughout Greater Lafayette, Crown Point and La Porte, Indiana.

Helpful Resources

Purdue Federal Credit Union may send you text messages and emails through your wireless provider to the mobile number and email address associated with your account. Card Fraud Alerts will be sent through U.S. carriers only and does not include international service. Purdue Federal Credit Union does not charge for Card Fraud Alerts, but you are responsible for all charges and fees associated with text messaging imposed by your wireless service provider.

Phone calls, text messages and emails may include personal or confidential information about you such as your account activity or the status of your account. Purdue Federal Credit Union shall not be responsible for the confidentiality, privacy or data security of any information sent to you through text messaging.

Members will indemnify, defend, and hold Purdue Federal Credit Union harmless from any third party claims. liability, damages or costs arising from your use of Card Fraud Alerts or from you providing us with a phone number or email address that is not your own.

Purdue Federal Credit Union will not be liable for failed, delayed, or misdirected delivery of any information sent through the Card Fraud Alerts service; any errors in such information; any action you may or may not take in reliance on the information; or any disclosure of account information to third parties resulting from your use of the Card Fraud Alerts service. Purdue Federal Credit Union will not be liable to you for special, indirect or consequential damages.